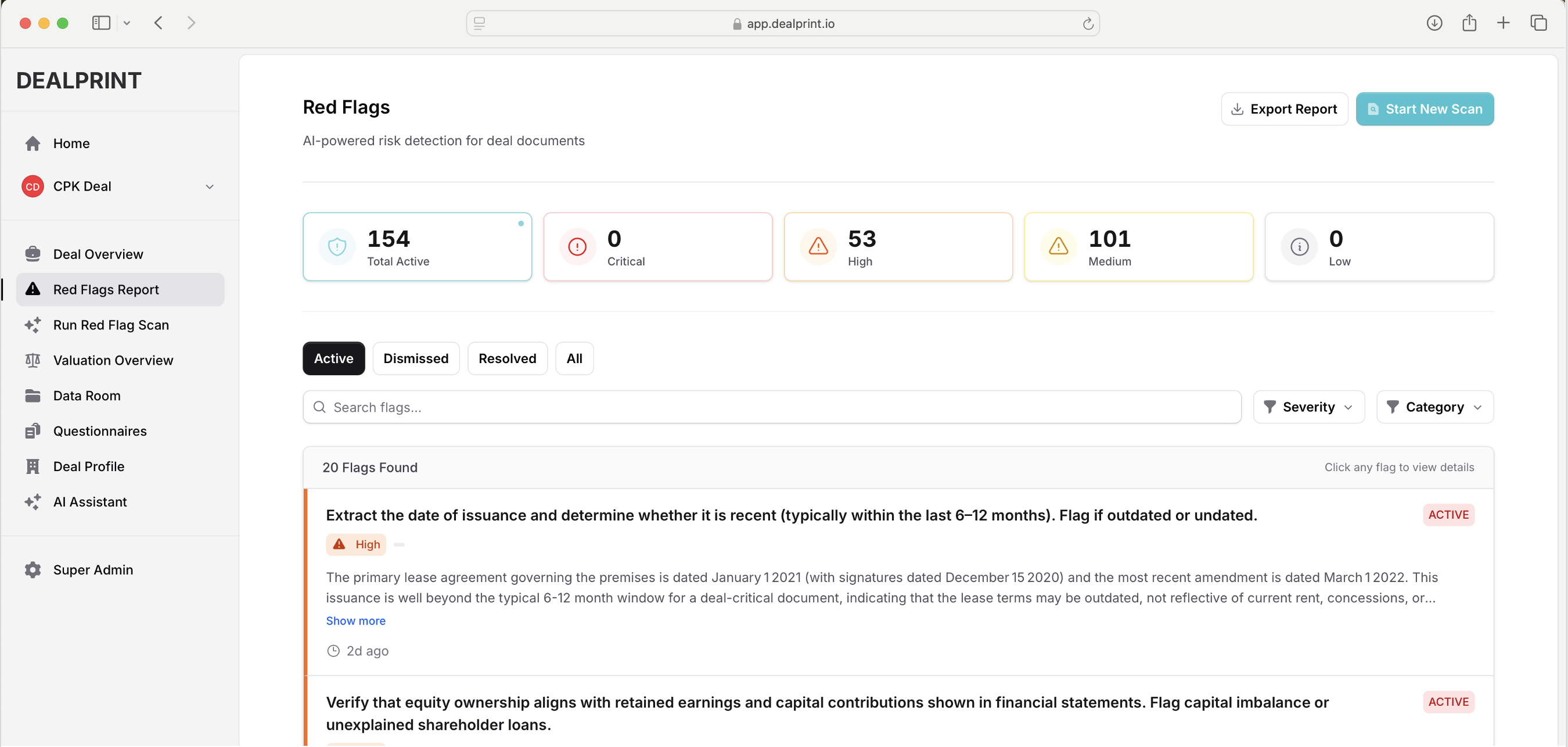

How it works

Due Diligence as Easy as 1-2-3

Analyze deals quicker, smarter, and more efficiently with our AI-powered due diligence platform.

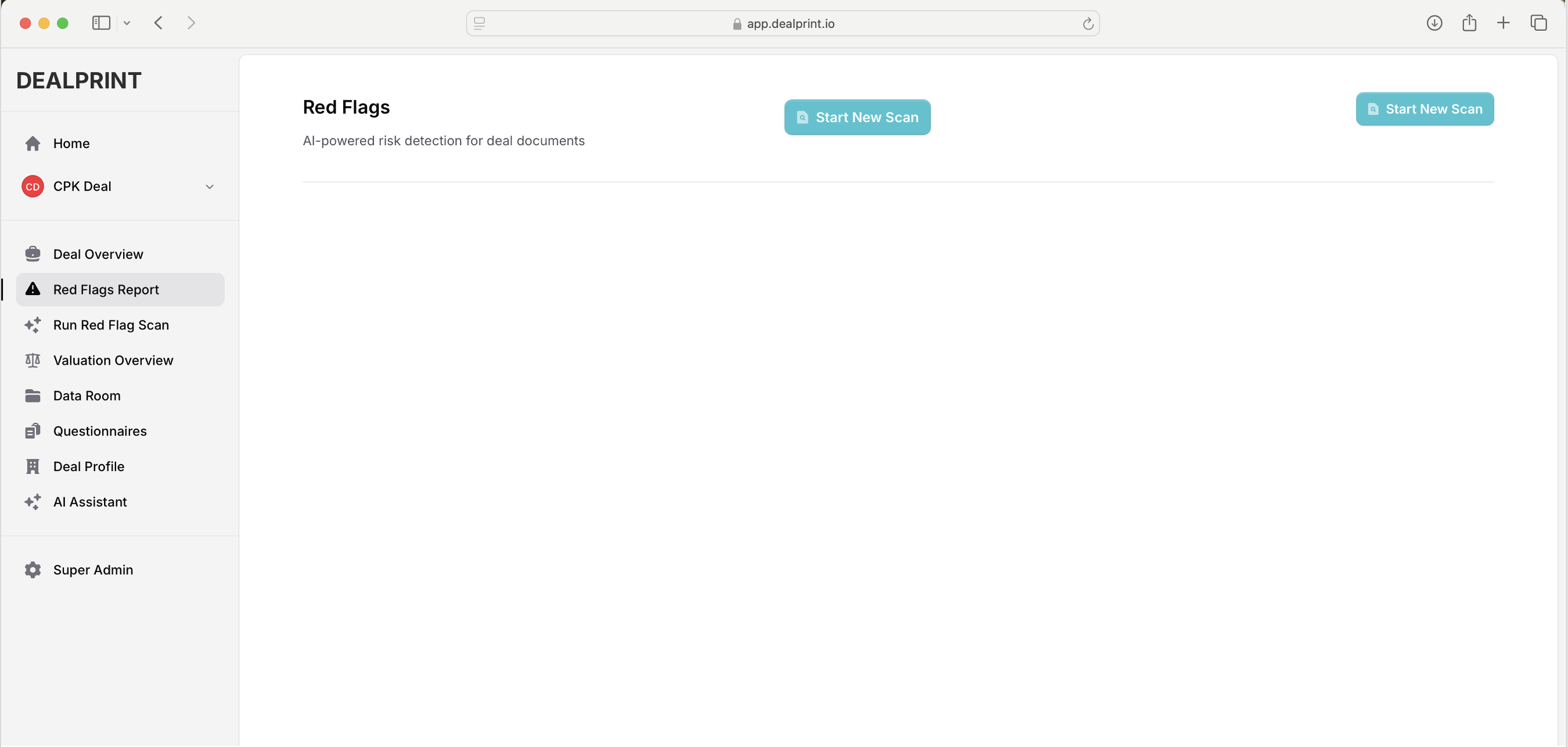

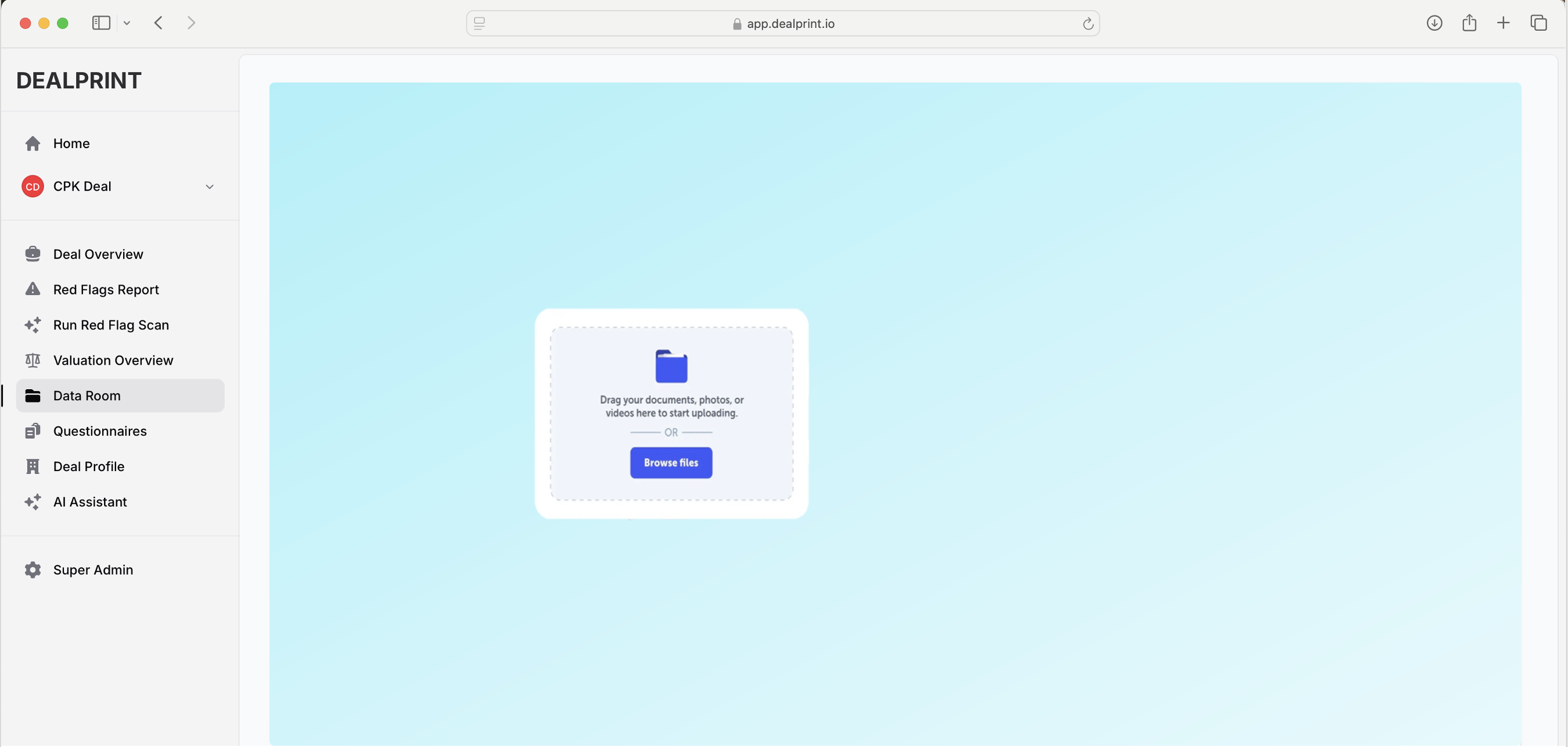

Upload documents

Whether from data rooms or seller emails, upload documents in any format to begin your due diligence process.

Key Features

Why SMB advisors and investors choose DEALPRINT.

Simplification

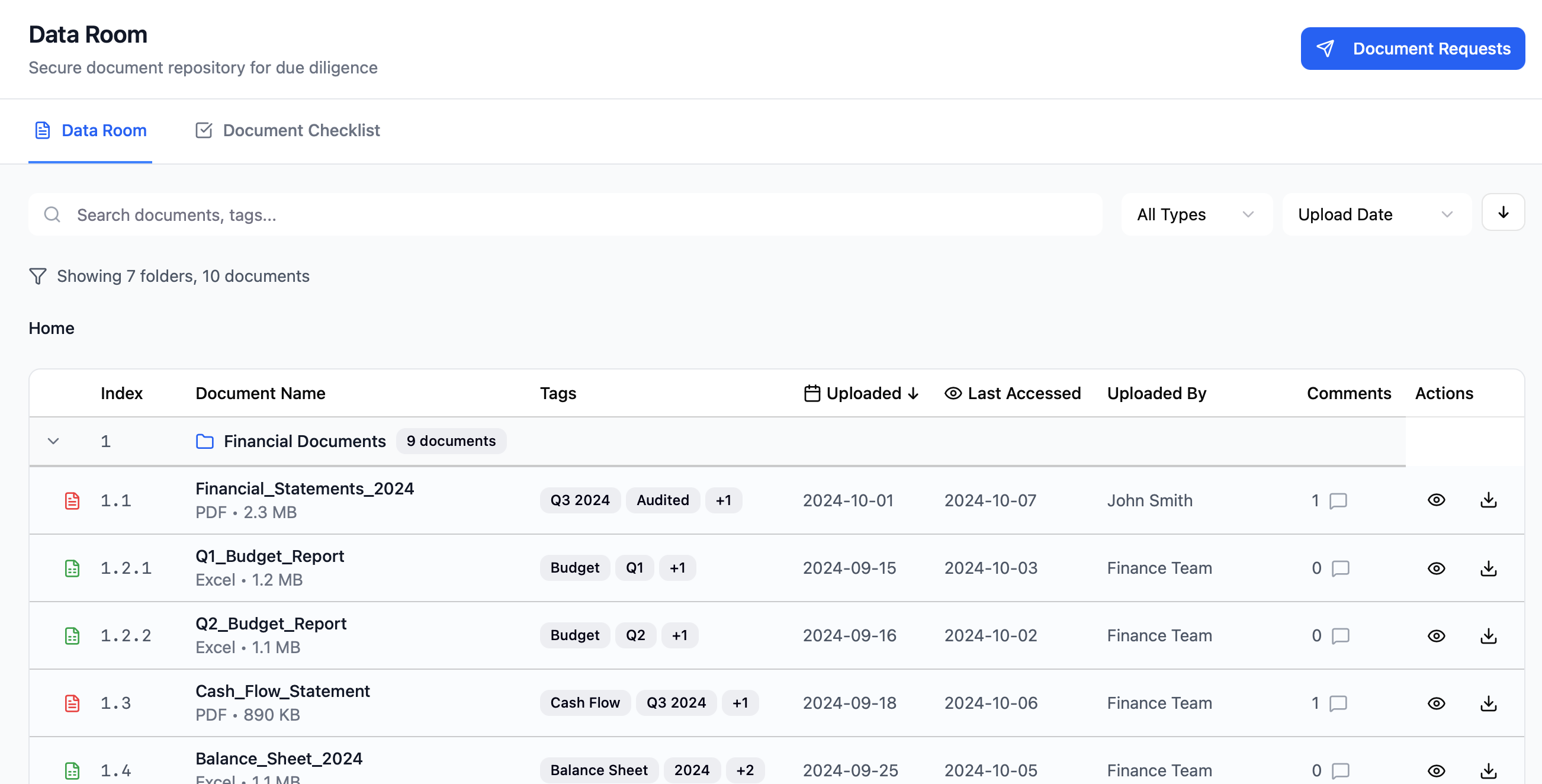

Dynamic Document Organization

DEALPRINT automatically indexes and organizes uploaded files based on content. Folders are created in intuitive categories to enhance your review.

Winning Playbooks

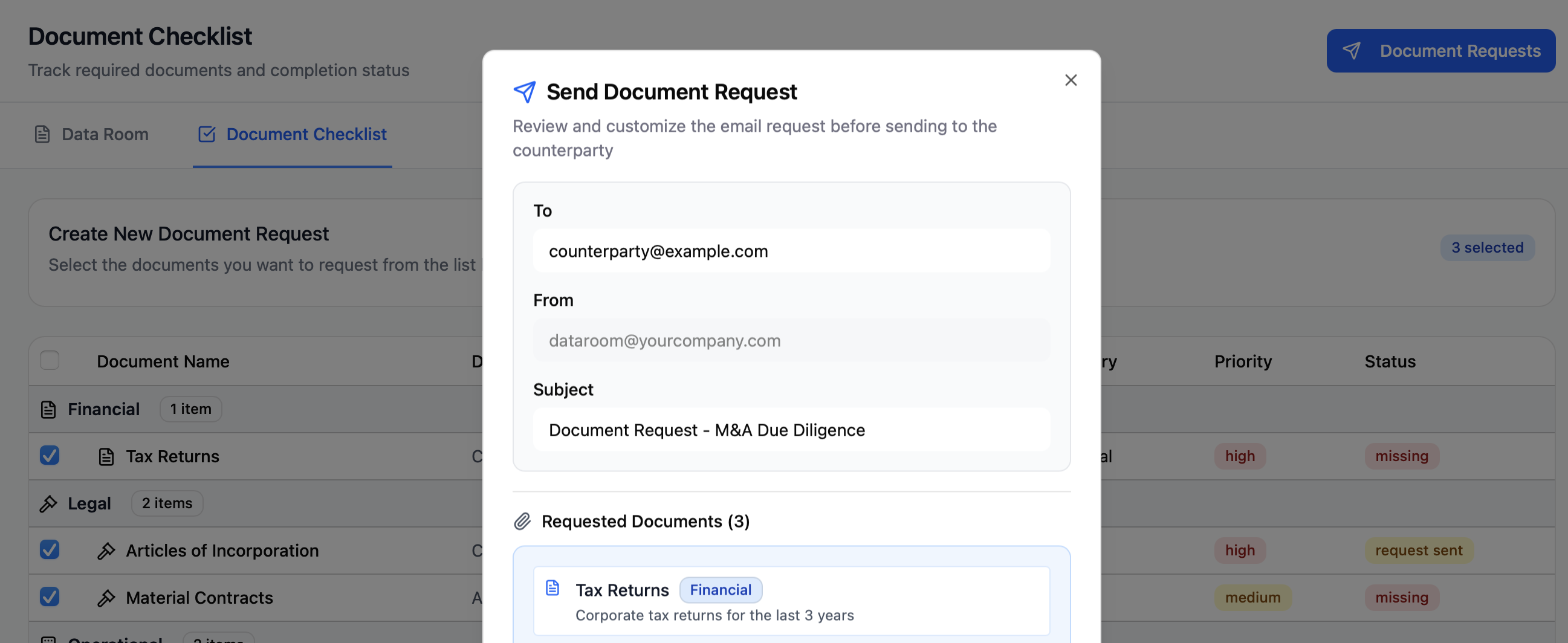

Automatic Document Request Lists

Never guess what else you need. DEALPRINT automatically generates request lists to highlight documents critical to the deal, documents lenders need, and documents other investors look for.

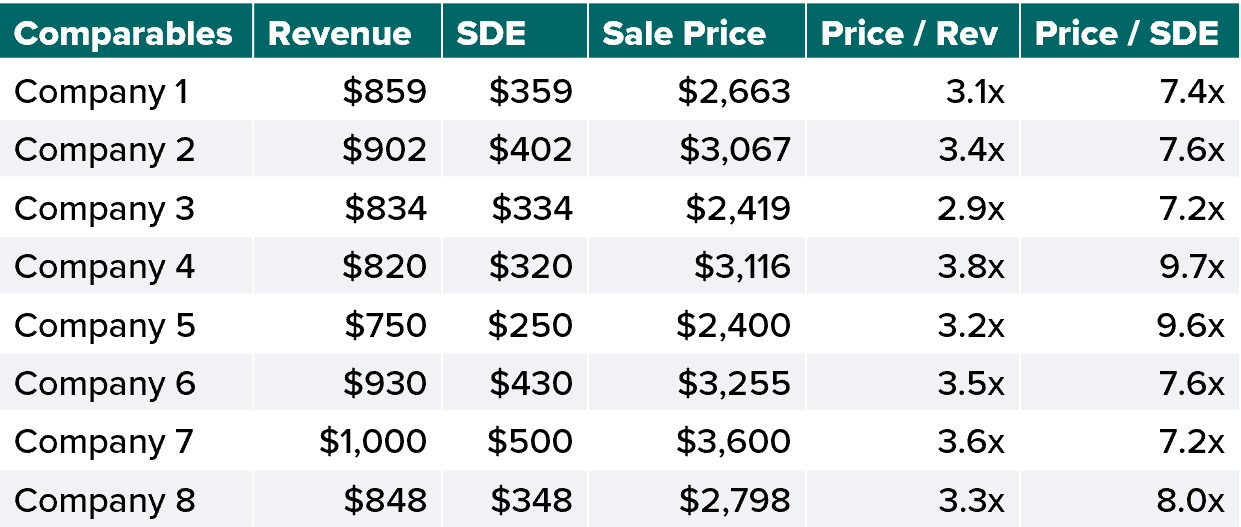

Valuation

Data-Driven Valuations

Generate accurate, benchmarked business valuations using cutting edge data-science based off of 50k+ comparable transactions.

Centralization

Manage Multiple Deals in One Place

No more chasing excel checklists. Streamline deal management in easy to follow, automated workflows that keep you driving deals forward.

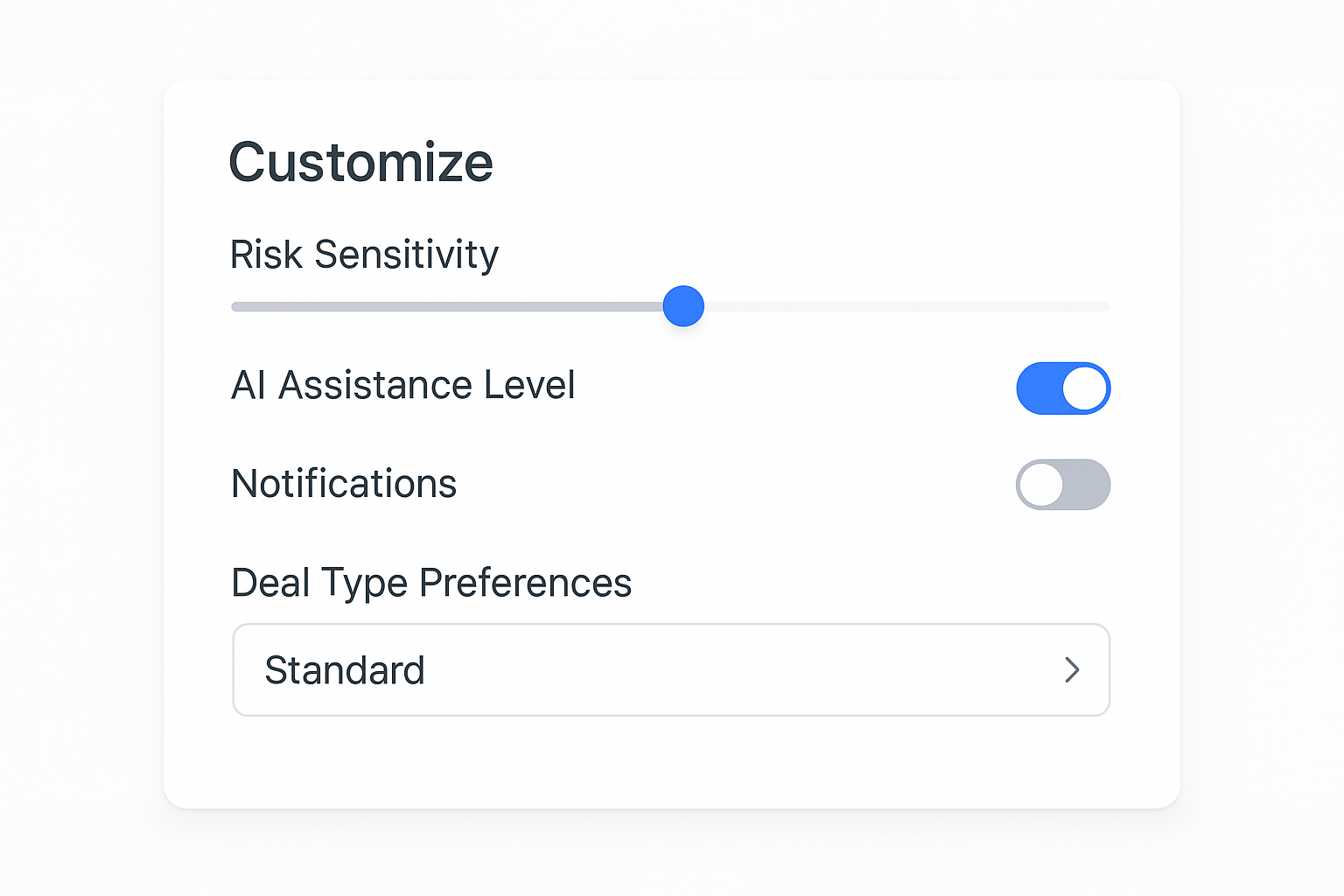

Customization

Tailor DEALPRINT to Your Needs

DEALPRINT was designed based on proven investment playbooks but might not match the way you work. No Problem. Customize diligence questions and analyses based on your working style.

Enterprise-Grade Security

Security without Compromise

Built with enterprise-grade security to keep your deal information safe and exclusively yours.

- Bank-Level Protection

- End-to-end encryption in transit and at rest

- Strict access controls

- Same security standards trusted by financial institutions

- Your Data Never Trains AI Models

- We don't train models on customer data, ever

- Your documents stay isolated to your workspace

- AI actions are runtime-only and scoped to your uploads

- Full Control Over Your Data

- Edit, export, or delete your data at any time

- You choose what to share, and with whom

- No hidden data retention